- Author Lauren Nevill nevill@internetdaybook.com.

- Public 2023-12-16 18:48.

- Last modified 2025-01-23 15:15.

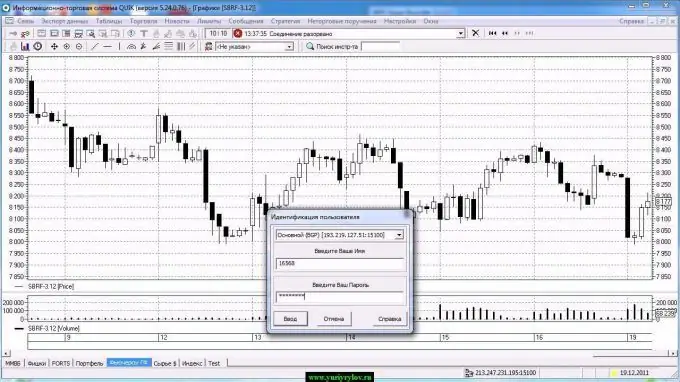

QUIK is an information and trading system, which is a front-office system with a large number of functions. Provides the user with access to trading for their own operations. How to make deals in QUIK and what is their peculiarity?

Basic information tables about bidding

The main tables, which contain data on trades and their movements, can be attributed to two:

- Parameter table. It displays all the latest and current values for all selected parameters. The user can view data on trading securities and trading modes in this table.

- Quotes window. Here, the user is clearly shown the states of supply and demand within the selected instruments. Orders can be sorted by price or by other parameters.

In order to open the quotes window, you should either switch to the active mode "Current table of parameters" and double-click on the instrument, or go to the software item "Trade", go to the item "Quotes" and select "Create" there,

How the deal is completed

Transactions are concluded according to the following scheme:

- To begin with, you need to open the quotes window and the table of results, and then select securities from the list of securities available for purchase and sale. In this case, the purchase and sale of securities and other assets can be carried out by sending a corresponding order to the broker through the QUIK system. This order is the client's consent to sell or buy booms, but only on the terms that were specified in the order.

- Wait until the application is accepted by the system server and passes the corresponding manual or automatic control. Immediately after passing this control, the completed transaction will be transferred to the trading system of the used exchange. And, of course, the order will be displayed in a special table with all orders.

Conditional claim

At the same time, it is necessary to take into account the fact that brokers in quik can also accept orders from their clients, which are executed depending on the achieved market value of the instrument. This order is called a conditional order or stop order. This application specifies two price parameters:

- Stop price, that is, a condition of the variation "the price of the last executed deal should not be more / less than the specified value." When this condition occurs, the order will be automatically activated, that is, transferred to the exchange as a standard limit order.

- The price indicated in the application at the time of sending to the exchange. Until certain conditions are met, stop orders are stored only on the server of the working broker, but the client can see them all in the table of active stop orders in the QUIK system.

And the last thing: during the entry of the order, the funds that will be required for the execution of the financial order will be blocked on the client's account. Only if there is a corresponding amount on the account, the transaction goes to the corresponding page.